Simplify your business with e-invoicing.

Experience seamless invoicing with our e-Invoice solution. Automate your billing process, reduce manual errors, and ensure that every transaction is compliant with LHDN's tax regulations. Spend less time on paperwork and more time growing your business.

What is e-Invoice?

e-Invoice system introduced by the Inland Revenue Board of Malaysia (LHDN) is part of Malaysia's efforts to digitalize and streamline the tax collection process, improving efficiency and compliance for businesses and taxpayers.

Digital Record Keeping

E-invoices are stored digitally, providing businesses with secure, accessible records for auditing and compliance purposes.

Real-Time Validation

Invoices are submitted directly to the Inland Revenue Board of Malaysia (LHDN) for real-time validation to ensure tax compliance and accuracy.

Secure and Accessible

E-invoices are digitally stored and can be easily retrieved for auditing purposes, enhancing business transparency and security.

Tax Compliance Automation

E-invoicing automatically calculates applicable SST and ensures invoices meet Malaysian tax laws, reducing the risk of errors.

Streamline your business process.

Experience fast, accurate, and tax-compliant invoicing with our powerful features.

MyInvois Ready Company Profile

Our POS system equips you to finalize your company profile with all necessary details for E-Invoice submission. It also highlights any missing information to ensure your profile is MyInvois Ready.

e-Invoice

Our efficient invoicing process simplifies E-Invoice submission to MyInvois with just one click. It supports credit note, debit note, sales invoice and return note generation.

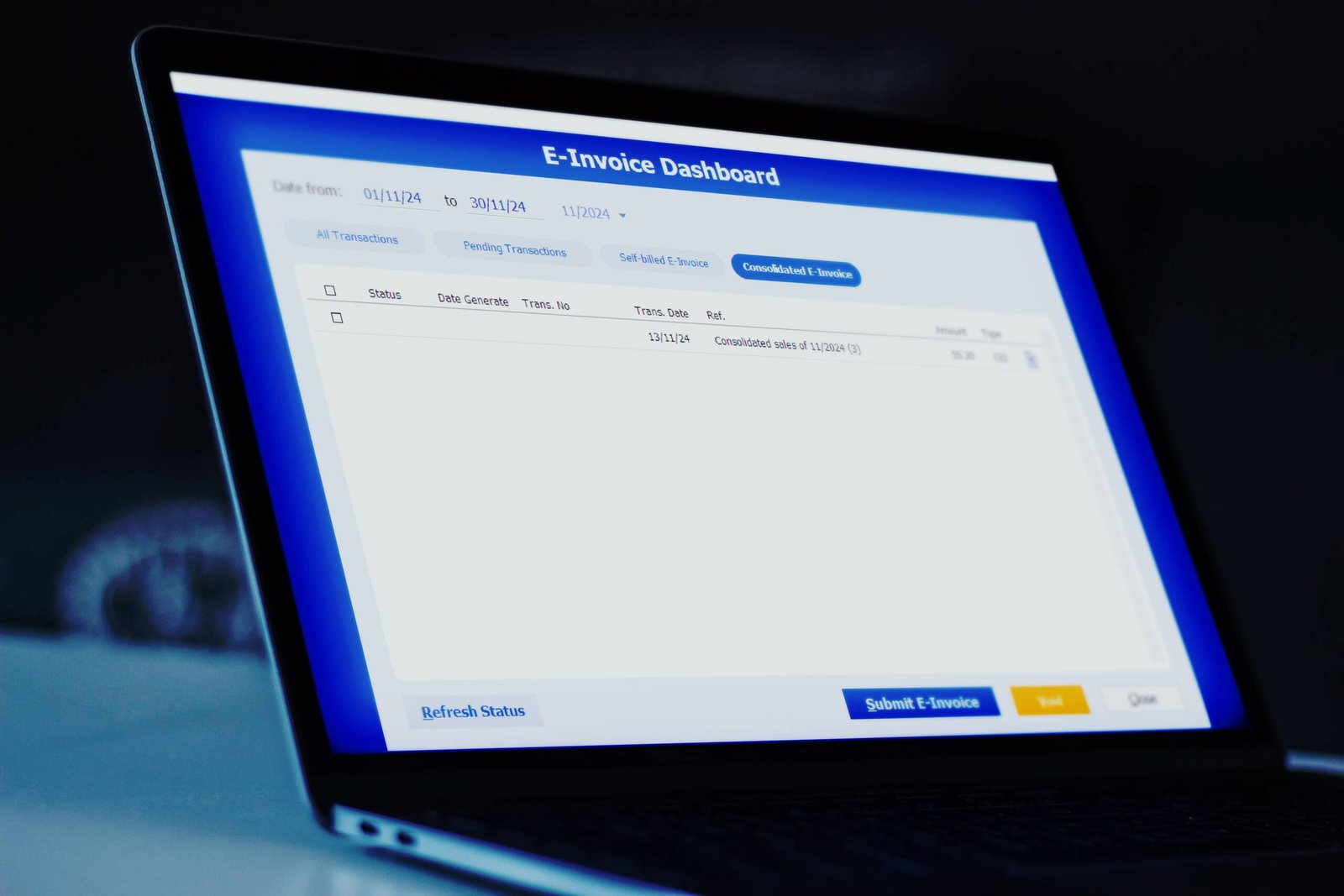

Consolidated e-Invoice

Our user-friendly interface lets you consolidate all transactions for the current month and submit them to the MyInvois Portal with just one click.

Self-Billed e-Invoice

If your suppliers cannot provide an E-Invoice, you must issue self-billed E-Invoices. Our POS system, you can effortlessly submit any purchase bills as self-billed E-Invoices to MyInvois with just one click.

Cancelling an e-Invoice

You can cancel an E-Invoice within 72 hours of submission to MyInvois, provided you specify a reason. You can cancel and resubmit the same e-Invoice by editing the existing one, there's no need to recreate a new e-Invoice again.

Autofill Function

Our system saves and auto-fills customer information, so you won't need to request or enter it again each time.

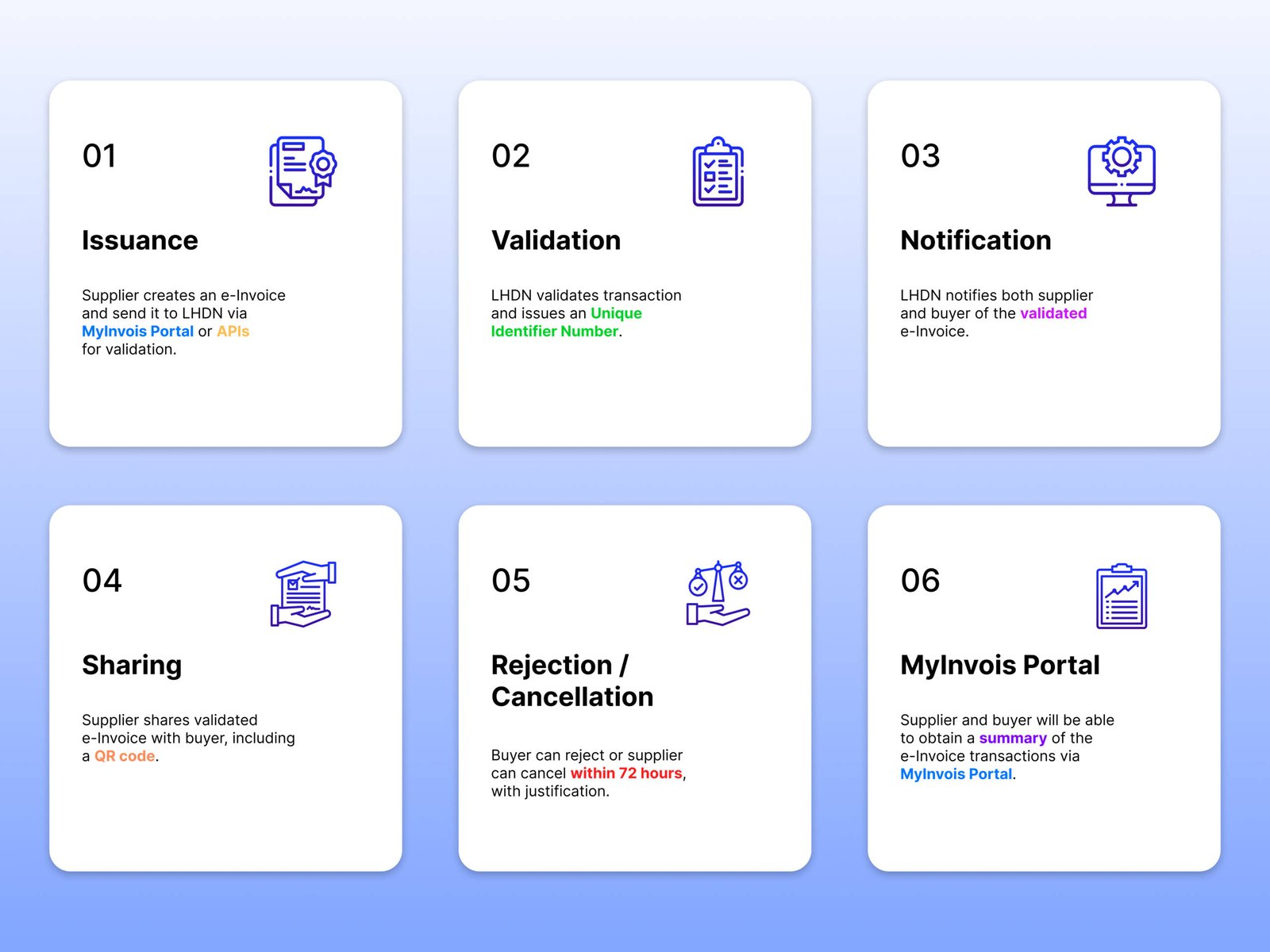

How e-Invoices works in Malaysia?

General Overview of e-Invoicing Process for B2B Transactions

B2C Transaction

Our E-Invoice solution streamlines the B2C e-invoicing process, allowing customers to easily request e-invoices. It guarantees full compliance with LHDN regulations, while providing a smooth and efficient experience for customers.

QR Code Request

Sync to POS System

Real-Time Update

e-Invoice Emails

B2B Transaction

Our flexible e-invoicing software offers a cost-effective solution for B2B businesses. Transfer data securely without integration, or easily connect via API to your existing systems, with no need for system changes or upgrades. Enjoy seamless e-invoicing today!

Autofill Information

UUID Records

Self-Billed e-Invoice

One Click Submission

Ready to Upgrade Your Business?

Get started with our e-Invoicing today and take the stress out of managing your business operation.

Questions & Answers

What is e-Invoicing, and why is it important for my business?

E-Invoicing is the process of generating and submitting invoices in a digital format, typically XML or JSON, directly to tax authorities like LHDN. It ensures accurate and compliant tax reporting, reduces manual errors, and speeds up the invoicing process, improving business efficiency.

What is the MyInvois Portal?

The MyInvois Portal is Malaysia’s official e-invoicing platform that enables businesses to issue, submit, and manage compliant invoices in a standardized format for real-time tax validation by LHDN.

Can e-invoices be cancelled or edited once submitted?

E-invoices can be edit within 72 hours of generation, but once validated, they cannot be edited. A new e-invoice must be issued for any changes.

Shall I issue e-invoices in Malaysia from 1 June 2024?

You are required to issue e-invoices according to the mandated timeline based on your business’s turnover. The first phase begins on 1st August 2024 for businesses with a turnover exceeding RM100 million. The second phase starts on 1st January 2025, covering businesses with a turnover of RM25 million or more. Finally, from 1st July 2025, e-invoicing will be mandatory for all remaining businesses.

Is e-Invoicing mandatory for all industries in Malaysia?

E-Invoicing is mandatory for businesses of all sizes and industries. However, to ensure a smoother transition, its implementation is being carried out in phases, depending on the turnover of each business.

What are the requirements for e-Invoicing in Malaysia?

A digital certificate is a mandatory requirement for e-Invoicing in Malaysia. It will be used for signing e-invoices and will be issued by IRBM based on the taxpayer’s TIN and other relevant information.

For DeepSky customers, don’t worry about the digital certificate – we’ve got it covered for you!

What are the consequences for failure to issue e-Invoice?

Failure to issue e-Invoice is an offence under Section 120(1)(d) of the Income Tax Act 1967 and will result in a fine of not less than RM200 and not more than RM20,000 or imprisonment not exceeding 6 months or both, for each non-compliance.

What is the required file format for e-invoices to be submitted for validation by LHDN in Malaysia?

In Malaysia, e-invoices must be submitted in XML or JSON format, as formats like PDF, JPG, and others are not accepted.

What is the e-Invoice Malaysia helpline number?

The e-Invoice HASiL Help Desk is available 24/7. You can reach them by calling 03-8682 8000 or emailing myinvois@hasil.gov.my, anytime from Monday to Sunday.